Thank you for Subscribing to Healthcare Business Review Weekly Brief

Be first to read the latest tech news, Industry Leader's Insights, and CIO interviews of medium and large enterprises exclusively from Healthcare Business Review

Enhancing Access to Care: Evolving Strategies in Medical Finance

The medical finance sector is evolving with patient-centered solutions and digitalization, using innovative strategies to improve access and sustainability in healthcare financing.

By

Healthcare Business Review | Wednesday, July 16, 2025

Stay ahead of the industry with exclusive feature stories on the top companies, expert insights and the latest news delivered straight to your inbox. Subscribe today.

The growing complexity of healthcare delivery has brought increased attention to the financial mechanisms that support medical access and institutional sustainability. As the cost of care continues to rise and the demand for advanced treatment options expands, the need for effective financial solutions in the healthcare sector has become more pronounced. Medical finance funding services have become a vital link between patients, healthcare providers, and the broader financial ecosystem.

Industry Dynamics and Financial Landscape

The medical finance funding service industry is witnessing significant transformation, shaped by evolving healthcare needs and changing financial behavior. One important trend is the increasing demand for patient-centric financing solutions. With rising healthcare costs and broader access to elective and specialized treatments, patients increasingly seek flexible payment options to manage expenses not covered by insurance.

Digitalization is another major trend in redefining the sector. Financial technology streamlines the application, approval, and repayment processes through online platforms and mobile applications. This digital shift enhances efficiency, reduces administrative burden, and improves user engagement.

Data-driven underwriting is also gaining momentum. Financial institutions are adopting advanced analytics and predictive models to assess creditworthiness more accurately. By analyzing healthcare usage patterns, payment history, and demographic data, lenders can offer more tailored financing products with improved risk management.

Diversification of service providers is expanding access to medical financing. Alongside traditional banks, non-bank lenders, fintech firms, and specialized investment groups are entering the market, offering innovative, sector-specific solutions.

There is an increased focus on funding emerging healthcare segments such as telehealth, wellness programs, and outpatient care. These trends reflect a shift toward more accessible, personalized, and technology-integrated medical finance solutions that align with modern healthcare delivery models.

Obstacles and Corresponding Resolutions

One of the prominent challenges stakeholders face in the medical finance funding ecosystem is creditworthiness evaluation, especially when offering loans to individuals. Traditional credit scoring systems may not accurately reflect a patient’s ability to repay medical expenses, particularly in emergencies. A viable solution has been the adoption of data-driven, predictive credit modeling that integrates healthcare usage patterns, insurance status, and historical payment behavior. This method provides a more comprehensive assessment, enhancing loan accessibility while maintaining financial prudence.

Regulatory complexity is another area of concern. The intersection of financial regulation and healthcare compliance creates a dual-layered framework that financial service providers must navigate. Noncompliance may lead to penalties and legal complications. To overcome this, institutions are implementing advanced compliance management tools and employing professionals with cross-disciplinary expertise. These systems automatically monitor changes in legislation and align operations accordingly, reducing risks and ensuring lawful operations.

Operational funding remains a challenge, particularly for small or independent practices that experience fluctuations in revenue. Delays in insurance reimbursements and irregular patient payments can hinder consistent cash flow, affecting daily operations and long-term planning. A solution to this issue lies in receivables-based financing, where healthcare providers can leverage outstanding invoices as collateral to obtain immediate working capital. This model ensures liquidity and allows medical practices to maintain service continuity.

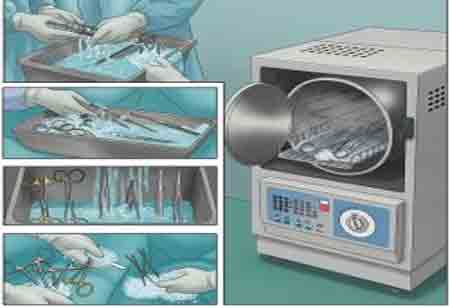

Given the high upfront costs, acquiring state-of-the-art medical equipment also poses a financial burden. To address this, leasing and installment-based financing options are offered, enabling providers to use the latest technologies without significant capital investment. These arrangements are particularly advantageous because they allow for regular upgrades, ensuring healthcare institutions remain technologically competitive without excessive financial strain.

The challenge of financial literacy among patients is being met through integrated education modules and support services embedded within financing platforms. By offering guidance on repayment terms, interest structures, and available subsidies, service providers empower patients to make informed decisions, thereby reducing default rates and enhancing trust in the system.

Emerging Potential and Sector Innovations

The medical finance funding service sector is undergoing rapid innovation, opening new opportunities for all stakeholders. Financial technology has revolutionized traditional models by introducing application processing, underwriting, and disbursement automation. Using AI and machine learning, these platforms offer tailored financing suggestions, detect fraud, and enable real-time decision-making, enhancing user engagement and operational effectiveness.

Another significant advancement is utilizing blockchain for transparent and secure financial transactions. Blockchain technology ensures that records related to medical expenses, insurance claims, and repayments are immutable and accessible only to authorized parties. This enhances data security and minimizes patient, provider, and financial institution disputes. It also streamlines multi-party interactions, reducing administrative overhead and fostering greater accountability.

Sustainability and social responsibility are becoming increasingly central to medical financing strategies. Institutions are prioritizing funding projects that align with eco-friendly standards and social equity. For instance, financing green-certified medical facilities or offering subsidized loans to rural and underserved areas demonstrates a commitment to long-term health equity. These efforts improve public health outcomes and enhance financing institutions' social standing and regulatory compliance.

New financial products are being created to support emerging sectors in healthcare, such as digital health platforms, mobile clinics, and specialized care centers. These diverse financing options allow providers to reach populations with unique medical needs, fostering a more inclusive health system.

Moreover, integrated healthcare-finance partnerships are on the rise. Financial solutions are increasingly embedded in the patient care journey, offering clear and manageable options at the point of care. This integration enhances patient satisfaction and boosts treatment acceptance, benefiting both patients and providers.